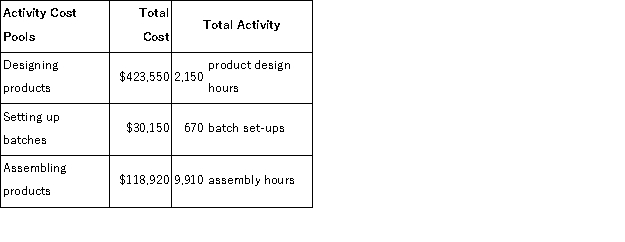

Malan Corporation has provided the following data from its activity-based costing accounting system:  Required:

Required:

Compute the activity rates for each of the three cost pools.Show your work!

Definitions:

Work in Process

Inventory that includes all materials, labor, and overhead costs for products that are in the process of being manufactured but are not yet completed.

Finished Goods

The final products that are completed and ready for sale to customers.

Job-Order Costing

An accounting methodology used to assign manufacturing costs to individual units or batches of production, based on the jobs performed.

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate manufacturing overhead costs to products.

Q2: The Lee Corporation uses a job-order costing

Q5: Fost Corporation's contribution margin ratio is 20%.If

Q55: Cost of goods sold equals beginning finished

Q73: Zumbrunnen Corporation uses activity-based costing to compute

Q80: When viewed over the long term, cumulative

Q81: Pabbatti Corporation, which has only one product,

Q83: Activity-based management seeks to eliminate waste by

Q114: Tawstir Corporation has 800 obsolete personal computers

Q155: Craft Corporation produces a single product.Last year,

Q196: Under variable costing, fixed manufacturing overhead is:<br>A)carried