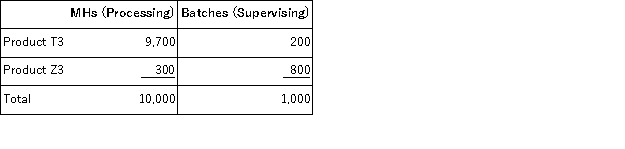

Glassey Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20, 000;Supervising, $33, 500;and Other, $16, 500.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  What is the overhead cost assigned to Product T3 under activity-based costing?

What is the overhead cost assigned to Product T3 under activity-based costing?

Definitions:

Predetermined Overhead Rate

A rate calculated before the accounting period begins, used to estimate the cost of manufacturing overhead for a specific activity base.

Machine-Hours

An indicator of the time spent in production, calculating the duration in hours that machinery is active during the manufacturing cycle.

Direct Labor-Hours

The accumulated hours spent by workers directly involved in manufacturing activities.

Forming

A manufacturing process used to shape metal or other materials using a combination of pressure and tooling.

Q5: Roberts Corporation manufactures home cleaning products.One of

Q6: The Lee Corporation uses a job-order costing

Q36: Schwering Corporation uses activity-based costing to assign

Q52: Christofferse Corporation bases its predetermined overhead rate

Q55: Cost of goods sold equals beginning finished

Q65: Walkenhorst Corporation has two divisions: Bulb Division

Q87: Criblez Corporation has two divisions: Blue Division

Q89: Fife & Jones PLC, a consulting firm,

Q106: Keske Corporation has an activity-based costing system

Q152: The constraint at Bonavita Corporation is time