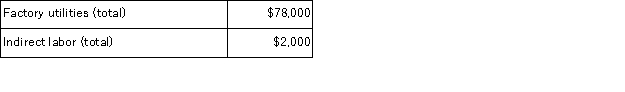

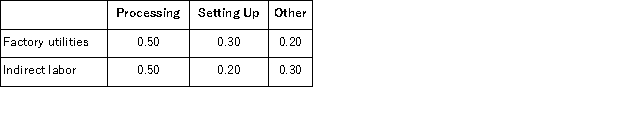

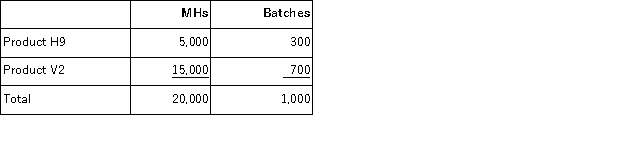

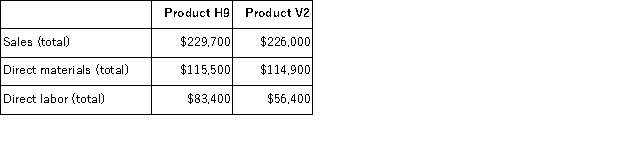

Barnette Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other.The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Costs in the Processing cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs and activity-based costing system appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

Required:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Definitions:

Final Goods

Products that have completed the production process and are ready for sale to the consumer or end-user, excluding intermediate goods used in production.

GDP Deflator

A measure of the level of prices of all new, domestically produced, final goods and services in an economy.

Real GDP

Gross Domestic Product adjusted for inflation, measuring the value of goods and services produced in a country, reflecting the actual changes in economic output.

Prices

Monetary values assigned to goods or services, determining the amount of money needed to purchase them.

Q20: Mussenden Corporation has an activity-based costing system

Q24: When considering a number of investment projects,

Q35: Andruschack Corporation uses activity-based costing to determine

Q51: Data concerning Hinkson Corporation's single product appear

Q88: The management of Fannin Corporation is considering

Q101: Falsetta Corporation makes three products that use

Q117: The required rate of return is the

Q118: Kosco Corporation produces a single product.The company's

Q122: O'Neill, Incorporated's segmented income statement for the

Q140: (Ignore income taxes in this problem. )Overland