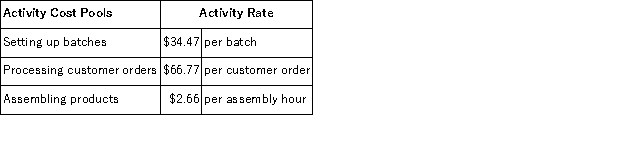

Villeda Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

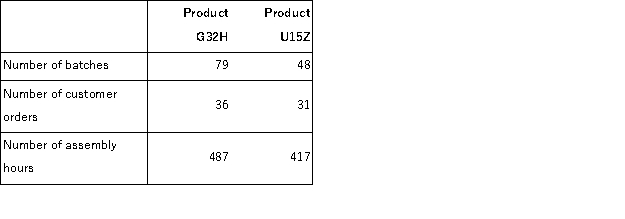

Data concerning two products appear below:  Required:

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Definitions:

Differential Rate

A rate that varies based on certain conditions or tiers, often used in interest rates or utility billing.

Commission Charges

Fees that are paid to an agent or service provider as compensation for facilitating transactions or services, typically calculated as a percentage of the sale price.

Proceeds

The total amount of money received from a transaction or event, such as the sale of assets or issuance of stock.

Commission Charges

Fees paid to agents or brokers for their services in facilitating transactions, usually calculated as a percentage of the transaction value.

Q23: Brannum Corporation has provided the following data

Q61: Mussenden Corporation has an activity-based costing system

Q63: The cost of goods sold in a

Q97: The most recent monthly income statement for

Q117: Oruro Chemical Corporation manufactures a variety of

Q124: Sproull Inc. , which produces a single

Q138: Upchurch Corporation produces and sells a single

Q142: Cutterski Corporation manufactures a propeller.Shown below is

Q199: Pevy Corporation has two divisions: Southern Division

Q212: Zimmerli Corporation manufactures a single product.The following