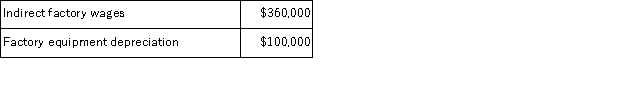

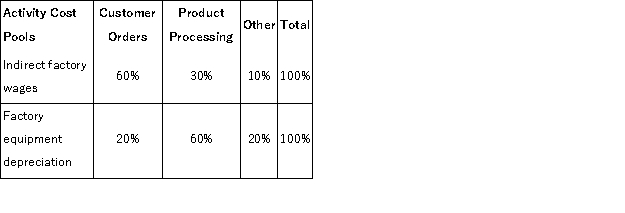

Ort Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

Definitions:

Manufacturing Overhead

All indirect costs associated with the production process, including but not limited to utilities, maintenance, and salaries of support staff.

Traditional Costing System

is an accounting method that applies indirect costs to products based on a predetermined rate, often not reflecting actual usage of resources.

Direct Labor-Hours

The total hours of labor directly involved in producing goods or performing services.

Predetermined Overhead Rate

A rate calculated before the accounting period begins, used to estimate the overhead costs per unit of activity.

Q48: Forse Florist specializes in large floral bouquets

Q54: (Ignore income taxes in this problem. )Pro-Mate,

Q55: The Gerald Corporation makes and sells a

Q75: Baker Corporation applies manufacturing overhead on the

Q77: Rosenbrook Corporation has provided the following data

Q82: Dilbert Farm Supply is located in a

Q120: Qabar Corporation, which has only one product,

Q131: Last year Easton Corporation reported sales of

Q136: Cutterski Corporation manufactures a propeller.Shown below is

Q168: Under variable costing, variable production costs are