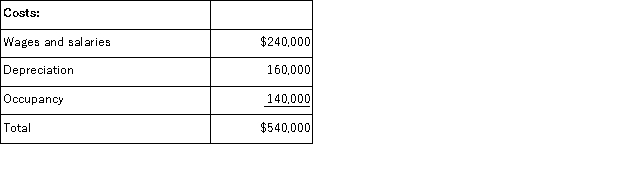

Grammer Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

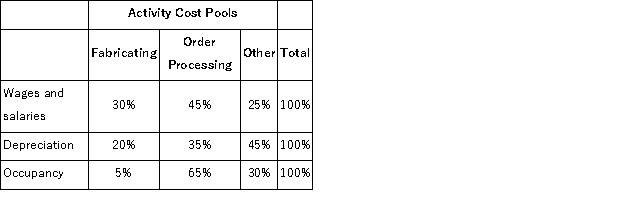

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

Definitions:

Social Security Taxes

Taxes collected from employees and employers to fund the Social Security program, which provides retirement, disability, and survivorship benefits.

Income Cap

A limit on the amount of income an individual or entity can receive, often used in tax or investment contexts to limit earnings or tax benefits.

Exemption

Exemption is a deduction allowed by law to reduce the amount of income that would otherwise be taxed. It can also refer to specific types of income or transactions that are legally excluded from taxation.

Terminal Illness

A disease or condition that is deemed incurable or irreversible and is expected to lead to the death of the patient within a short period of time.

Q21: Salley Corporation produces and sells a single

Q66: Data for March for Lazarus Corporation and

Q75: Bolding Inc.'s contribution margin ratio is 61%

Q80: Bowen Corporation produces products P, Q, and

Q114: The Covey Corporation is preparing its Manufacturing

Q128: Discounted cash flow techniques do not take

Q134: In activity-based costing, organization-sustaining costs should be

Q147: Bredder Supply Corporation manufactures and sells cotton

Q147: (Ignore income taxes in this problem. )The

Q224: Bode Corporation has two divisions: East and