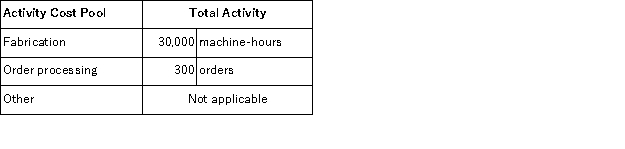

Hochberg Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

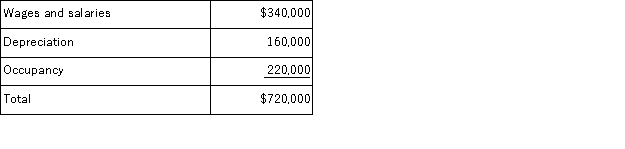

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

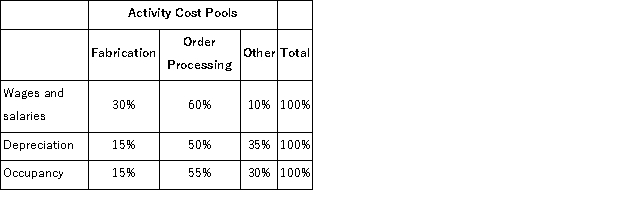

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Fabrication activity cost pool is closest to:

The activity rate for the Fabrication activity cost pool is closest to:

Definitions:

Derivative

A contract that changes value in response to an underlying variable, requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors, and is settled at a future date.

Primary

Refers to being of first importance; main or most significant in terms of consideration or development.

Non-Derivative

A non-derivative is a financial instrument without any underlying assets; its value is determined by the instrument itself, such as stocks or bonds, as opposed to derivatives like options or futures.

Derivative

A financial instrument whose value is derived from the value of another asset, which can include options, futures, and swaps.

Q9: Grammer Corporation uses an activity-based costing system

Q22: Waltz Corporation has two divisions: Xi and

Q30: The Thornes Cleaning Brigade Company provides housecleaning

Q53: Belsky Corporation has provided the following data

Q69: On a cost-volume-profit graph, the revenue line

Q76: The manufacturing overhead budget at Cardera Corporation

Q81: (Ignore income taxes in this problem. )Allen

Q88: Manton Corporation uses an activity based costing

Q98: Lafoe Corporation produces two intermediate products, A

Q118: In two companies making the same product