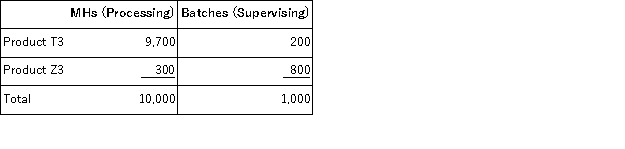

Glassey Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20, 000;Supervising, $33, 500;and Other, $16, 500.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  What is the overhead cost assigned to Product T3 under activity-based costing?

What is the overhead cost assigned to Product T3 under activity-based costing?

Definitions:

Very Liquid Stool

Diarrhea, a condition in which feces are discharged from the bowels frequently and in a liquid form.

Sigmoid

Refers to the S-shaped section of the large intestine that connects the descending colon to the rectum.

Ascending

Moving upward or advancing to higher levels or positions.

Opioid Use

The consumption of opioid substances, either medically prescribed for pain relief or illicitly used.

Q13: The labor time ticket contains a detailed

Q17: Malley Corporation has provided the following data

Q32: Vassallo Corporation's activity-based costing system has three

Q52: Duarte Corporation processes sugar beets that it

Q53: The most common accounting treatment of underapplied

Q70: Darwin Inc.sells a particular textbook for $20.Variable

Q71: Westgaard Inc.uses a job-order costing system in

Q126: (Ignore income taxes in this problem. )The

Q153: Mitchener Corp.manufactures three products from a common

Q160: Gabbert Corporation, which has only one product,