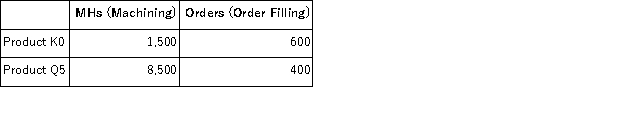

Mciver Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $10, 900;Order Filling, $10, 500;and Other, $75, 600.Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Written Contract

A legally binding agreement between two or more parties that is put in writing and signed by the parties involved.

Installments

Regular partial payments made over a period of time to settle a debt or purchase price, rather than paying the total amount at once.

Proceeds

The total amount of money or assets derived from a transaction or event, often used in the context of sales and financings.

Monthly Payments

Regular payments made every month towards the repayment of a loan, mortgage, or other financial obligation.

Q5: Vanikord Corporation currently has two divisions which

Q43: Duarte Corporation processes sugar beets that it

Q79: (Ignore income taxes in this problem. )The

Q91: Messana Corporation reported the following data for

Q108: During its first year of operations, Carlos

Q112: Vinup Corporation has provided the following data

Q114: The Covey Corporation is preparing its Manufacturing

Q137: Romasanta Corporation manufactures a single product.The following

Q155: (Ignore income taxes in this problem. )Carlson

Q182: Under variable costing, product cost does not