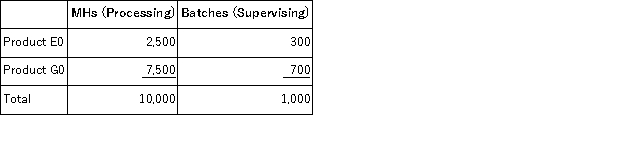

Trainor Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $29, 200;Supervising, $13, 000;and Other, $26, 800.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Economic Sense

The rationality or logic underlying financial decisions or policies.

Leisure Time

is time free from work or duties, allowing individuals to engage in recreational activities or rest.

Industrial Productivity

A measure of the efficiency of industrial production, typically evaluated as the output of goods produced by a sector per unit of labor or capital.

Technologies

The application of scientific knowledge for practical purposes, especially in industry and everyday life.

Q3: One assumption in CVP analysis is that

Q69: (Ignore income taxes in this problem. )Buy-Rite

Q71: The project profitability index is used to

Q75: Bolding Inc.'s contribution margin ratio is 61%

Q95: Mankus Inc.is considering using stocks of an

Q101: Falsetta Corporation makes three products that use

Q124: Sproull Inc. , which produces a single

Q135: Farnsworth Television makes and sells portable television

Q139: The net present value of a proposed

Q165: Clay Corporation has projected sales and production