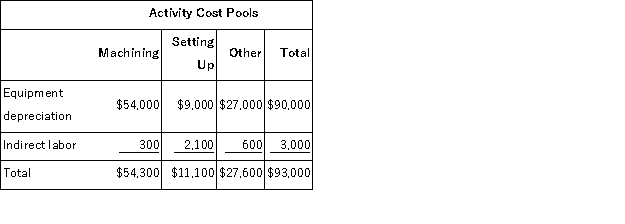

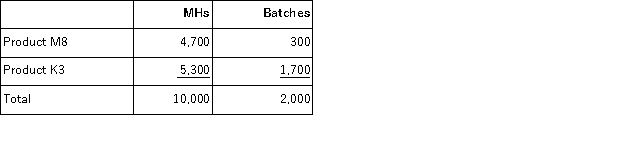

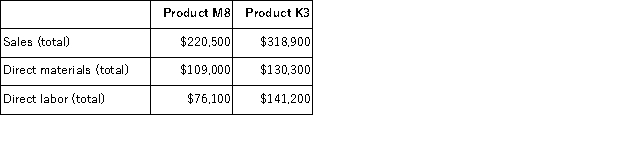

Somani Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other.The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs appear below:

Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c.Determine the product margins for each product using activity-based costing.

Definitions:

Medication Error

A preventable mishap that may cause or lead to inappropriate medication use or harm to a patient.

Negligence

The failure to take proper care in doing something, which can lead to unintended harm or injury to someone owed a duty of care.

Informed Consent

A client’s agreement to accept a course of treatment or a procedure after receiving complete information, including the risks of treatment and facts relating to it, from the physician.

Fracturing His Hip

The act of breaking the bone in the hip, often requiring medical treatment and rehabilitation.

Q4: Raskin Inc.uses job-order costing.In September, the company

Q6: The Lee Corporation uses a job-order costing

Q25: Mahugh Corporation, which has only one product,

Q109: Carsten Wedding Fantasy Corporation makes very elaborate

Q122: Parliman Corporation is preparing its cash budget

Q133: Assembling a product is an example of

Q144: Preference decisions follow screening decisions and seek

Q157: Iancu Corporation, which has only one product,

Q164: (Ignore income taxes in this problem. )Juliar

Q166: Management is considering a one-time-only special order.There