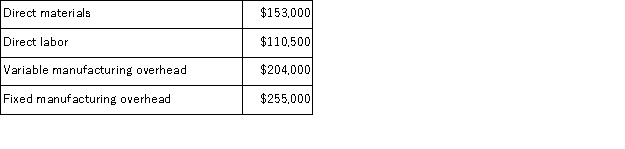

Harris Corporation produces a single product.Last year, Harris manufactured 17, 000 units and sold 13, 000 units.Production costs for the year were as follows:  Sales were $780, 000 for the year, variable selling and administrative expenses were $88, 400, and fixed selling and administrative expenses were $170, 000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing, the company's net operating income for the year would be:

Sales were $780, 000 for the year, variable selling and administrative expenses were $88, 400, and fixed selling and administrative expenses were $170, 000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing, the company's net operating income for the year would be:

Definitions:

Statement of Operations

A financial report that summarizes the revenue, expenses, and profits or losses of an organization over a specific period, typically a fiscal quarter or year.

Disbursement Basis

An accounting method where expenses are recorded when cash is paid out rather than when the expense is incurred.

Consolidation

The merging of assets, liabilities, and other financial items of two or more entities to form a single, combined financial statement.

Investment

Allocation of resources, usually money, in assets or projects expected to generate income or profit in the future.

Q10: Krimton Corporation's manufacturing costs last year consisted

Q61: Indirect labor is a(n):<br>A)Prime cost.<br>B)Conversion cost.<br>C)Period cost.<br>D)Opportunity

Q68: Teich Inc.is considering whether to continue to

Q84: Crane Corporation makes four products in a

Q90: Benjamin Signal Company produces products R, J,

Q124: Buccheri Corporation produces and sells a single

Q181: Pevy Corporation has two divisions: Southern Division

Q181: Upchurch Corporation produces and sells a single

Q182: Under variable costing, product cost does not

Q196: Under variable costing, fixed manufacturing overhead is:<br>A)carried