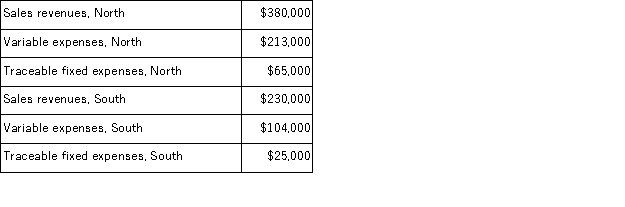

Data for March for Lazarus Corporation and its two major business segments, North and South, appear below:  In addition, common fixed expenses totaled $156, 000 and were allocated as follows: $84, 000 to the North business segment and $72, 000 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

In addition, common fixed expenses totaled $156, 000 and were allocated as follows: $84, 000 to the North business segment and $72, 000 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

Definitions:

CCA Class

Refers to the Canada Revenue Agency's categorization of depreciable properties for the purpose of determining their depreciation rate for tax purposes.

Discount Rate

The interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows, reflecting the time value of money and risk.

NPV

Net Present Value: a capital budgeting technique that assesses the profitability of a proposed investment or project.

CCA Rate

Capital Cost Allowance Rate, which is the rate at which businesses in Canada can claim depreciation on certain assets for tax purposes.

Q11: A customer has requested that Gamba Corporation

Q18: Villeda Corporation uses the following activity rates

Q20: Mussenden Corporation has an activity-based costing system

Q61: Caber Corporation applies manufacturing overhead on the

Q97: The controller of Hartis Corporation estimates the

Q102: Selling costs can be either direct or

Q137: Romasanta Corporation manufactures a single product.The following

Q174: Sharron Inc. , which produces a single

Q187: Nelson Corporation, which has only one product,

Q205: Warburton Corporation has two divisions: Alpha and