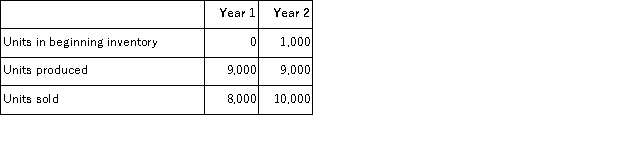

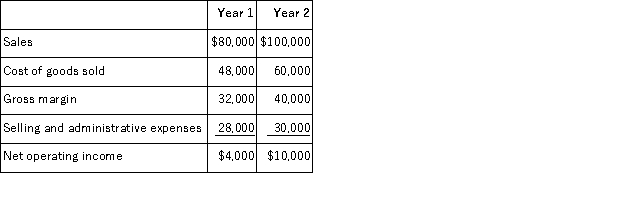

Hanks Corporation produces a single product.Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18, 000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18, 000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Required:

a.Compute the unit product cost in each year under variable costing.

b.Prepare new income statements for each year using variable costing.

c.Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Acquisition

The process of acquiring or gaining knowledge, skills, or behaviors through learning or experience.

Storage

The process by which information is encoded, retained, and retrieved in the brain.

Tip-of-the-Tongue Phenomenon

A psychological phenomenon where a person is unable to recall a familiar word or name, despite feeling that it is just out of reach.

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired; a response that is at first elicited by the second stimulus is eventually elicited by the first stimulus alone.

Q25: Mahugh Corporation, which has only one product,

Q41: The following data have been provided by

Q67: Sigel Corporation bases its predetermined overhead rate

Q89: Fife & Jones PLC, a consulting firm,

Q96: Tondre Inc.has provided the following data for

Q129: Lusk Corporation produces and sells 20, 000

Q132: Smee Inc.produces and sells a single product.The

Q141: Hatfield Corporation, which has only one product,

Q144: Vontungeln Corporation uses activity-based costing to compute

Q175: Conversion cost equals product cost less direct