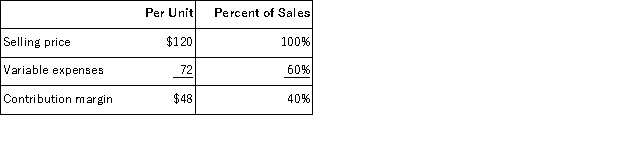

Data concerning Marchman Corporation's single product appear below:  The company is currently selling 4, 000 units per month.Fixed expenses are $166, 000 per month.Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Marchman Corporation.Refer to the original data when answering this question.

The company is currently selling 4, 000 units per month.Fixed expenses are $166, 000 per month.Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Marchman Corporation.Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $8 per unit.In exchange, the sales staff would accept a decrease in their salaries of $27, 000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Primary Sector

The sector of an economy involving the extraction and harvesting of natural resources directly from the earth, such as agriculture, mining, and forestry.

Tertiary Sector

This term refers to the sector of an economy focused on services rather than the production of goods, including areas such as retail, entertainment, and financial services.

Secondary Sector

The part of the economy that includes industries involved in the processing, transformation, fabrication, or construction of materials and products from raw materials.

Rational-Legal

An authority system based on legal rules and regulations, and the rationality of law, often associated with modern bureaucracies.

Q14: If the formula for the markup percentage

Q28: A partial listing of costs incurred during

Q30: Iancu Corporation, which has only one product,

Q42: When variable costing is used, and if

Q42: (Appendix 12B)The Hudson Block Company has a

Q43: When using data from a segmented income

Q51: Cervetti Corporation has two major business segments-East

Q55: In a traditional format income statement for

Q66: The formula for target cost is:<br>A)Target cost

Q89: Fife & Jones PLC, a consulting firm,