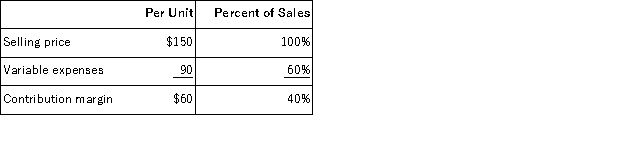

Wrobbel Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $307, 000 per month.The company is currently selling 6, 000 units per month.

Fixed expenses are $307, 000 per month.The company is currently selling 6, 000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $2.Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 200 units.What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Definitions:

Profit

The financial gain realized when the revenue generated from business activities exceeds the expenses, taxes, and costs incurred in sustaining business operations.

Contribution Margin Ratio

A financial metric that measures the proportion of revenue that exceeds variable costs, indicating how much revenue contributes towards covering fixed costs and generating profit.

Variable Expenses

Costs that change in proportion to the level of activity or volume of output in a business.

Fixed Expenses

Costs that do not change in total regardless of the level of production or sales activity, such as rent and salaries.

Q8: Data for March for Lazarus Corporation and

Q12: Under variable costing, which of the following

Q18: Lasseter Corporation has provided its contribution format

Q19: (Appendix 12A)One disadvantage of using the actual

Q33: A new product, an automated crepe maker,

Q47: During its first year of operations, Carlos

Q47: The management of Tamondong Corporation has provided

Q55: Harris Corporation produces a single product.Last year,

Q63: Yankee Corporation manufactures a single product.The company

Q116: Dace Company manufactures two products, Product F