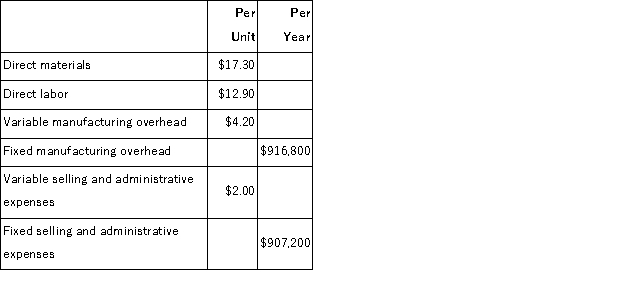

Qualls Corporation makes a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 48, 000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 48, 000 units per year.

The company has invested $360, 000 in this product and expects a return on investment of 15%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

c.Assume that every 10% increase in price leads to a 13% decrease in quantity sold.Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

Definitions:

Comparative Advantage

The capability to produce a particular good or service more efficiently than other producers, allowing for trade benefits.

Absolute Advantage

Absolute Advantage refers to the ability of a party to produce a good or service more efficiently than its competitors, using fewer resources.

Banana Production

The agricultural cultivation and harvesting of bananas, typically in tropical and subtropical regions.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits lost by choosing one option over another.

Q8: (Appendix 5A)Prehn Corporation manufactures and sells one

Q24: (Appendix 11A)Steinhagen Corporation applies manufacturing overhead to

Q49: Qualls Corporation makes a product that has

Q51: (Appendix 11A)A furniture manufacturer uses a standard

Q72: (Appendix 11A)Nitrol Corporation manufactures brass vases using

Q97: A manufacturer of premium wire strippers has

Q116: (Appendix 8C)Erling Corporation has provided the following

Q120: Data for Cost A and Cost B

Q133: (Appendix 8C)Foucault Corporation has provided the following

Q165: Data concerning Marchman Corporation's single product appear