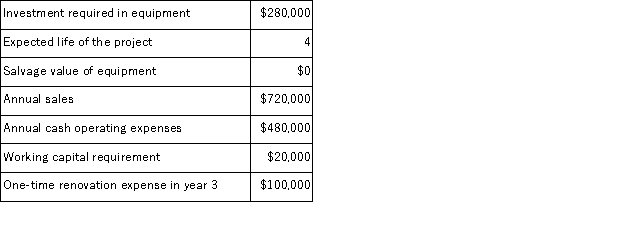

(Appendix 8C) Erling Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 15%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 35% and its after-tax discount rate is 15%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 3 is:

Definitions:

Brown-bag Lunch

An informal meeting or training session during lunchtime where participants bring their own food.

Wellness Program

An organized initiative aimed at promoting healthier lifestyles among employees or members of an organization.

Defined Benefit

A type of pension plan in which an employer promises a specified monthly benefit upon retirement, which is predetermined by a formula based on the employee's earnings history, tenure of service, and age.

Employee Retirement Income Security Act

A federal law that sets standards for pension and health plans to provide protection for individuals in these plans.

Q1: Gardner believes that schools should foster all

Q8: (Appendix 4A)Koszyk Manufacturing Corporation has a traditional

Q10: (Appendix 8C)Boch Corporation has provided the following

Q33: (Appendix 8C)Shinabery Corporation has provided the following

Q48: (Appendix 5A)Slezak Corporation manufactures and sells one

Q58: (Appendix 8C)Kostka Corporation is considering a capital

Q68: (Appendix 8C)Shinabery Corporation has provided the following

Q75: The management of Liess Corporation has provided

Q100: (Appendix 11A)Pohl Corporation uses a standard cost

Q110: (Appendix 11A)Acuff Corporation applies manufacturing overhead to