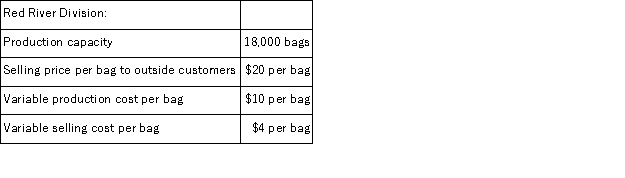

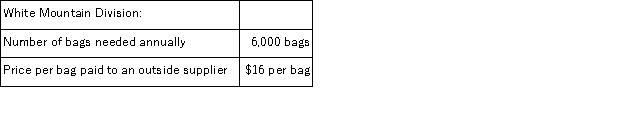

(Appendix 12A) The Red River Division of Alto Company produces and sells bags of pottery clay which can either be sold to outside customers or transferred to the White Mountain Division of Alto Company.The following data are available for the last year:

By selling to the White Mountain Division, the Red River Division will avoid $3 per bag in selling costs. If Red River can sell only 10, 000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

By selling to the White Mountain Division, the Red River Division will avoid $3 per bag in selling costs. If Red River can sell only 10, 000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Definitions:

Net Income

The net income of a company once all costs and taxes are subtracted from the total earnings.

Total Assets Turnover

A financial ratio that measures a company's efficiency in using its assets to generate revenue.

Sales

Revenue generated from the sale of goods or services.

Total Assets

The sum of all current and long-term assets owned by a company, reflected on the balance sheet.

Q3: (Appendix 2A)Below are cost and activity data

Q9: (Appendix 5A)Super-variable costing is a costing method

Q16: Ritchie Corporation manufactures a product that has

Q17: The management of Featherston, Inc. , is

Q35: Hoop Corporation has four different products that

Q60: Daisley Products Inc.makes two products-B17U and R94X.Product

Q62: Comco, Inc.has accumulated the following data for

Q79: Inventoriable costs are also known as:<br>A)variable costs.<br>B)conversion

Q110: Anderson Corporation has provided the following production

Q117: (Appendix 8C)Credit Corporation has provided the following