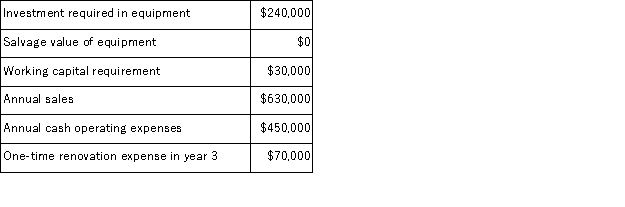

(Appendix 8C) The following information concerning a proposed capital budgeting project has been provided by Wick Corporation:  The expected life of the project is 4 years.The income tax rate is 35%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The expected life of the project is 4 years.The income tax rate is 35%.The after-tax discount rate is 14%.The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60, 000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Self-Efficacy

The belief in one's ability to succeed in specific situations or accomplish a task.

Dissemination

The act of spreading information, knowledge, or ideas to a wide audience.

Behavior Change

A modification in an individual's actions, habits, or attitudes often aimed at improving personal health or adapting to new circumstances.

Food Preparation

The process of planning, cooking, and arranging food for consumption, taking into account health and safety standards.

Q1: (Appendix 8A)The present value of a cash

Q1: (Appendix 12B)Layton Company operates a free day-care

Q8: (Appendix 5A)Prehn Corporation manufactures and sells one

Q12: (Appendix 2A)When analyzing a mixed cost, you

Q29: (Appendix 5A)Phoeuk Corporation manufactures and sells one

Q29: (Appendix 8C)Lastufka Corporation is considering a capital

Q30: (Appendix 5A)Phoeuk Corporation manufactures and sells one

Q71: The Sloan Corporation must invest $120, 000

Q90: Which of the following is NOT one

Q107: (Appendix 8C)Forehand Corporation has provided the following