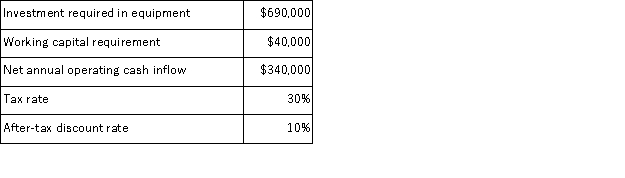

(Appendix 8C)Crabill Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Vertical Analysis

A method of financial statement analysis where each entry for a given period is represented as a proportion of a specific base figure.

Financial Statement Data

Information contained in financial statements, including balance sheets, income statements, and cash flow statements, that provides insights into a company's financial health.

Vertical Analysis

A method of financial statement analysis in which each entry for each of the three major categories of accounts (assets, liabilities, and equity) in a balance sheet is represented as a proportion of the total account.

Common Size Analysis

A financial analysis technique that expresses each line item on a financial statement as a percentage of a base amount for easy comparison across periods or companies.

Q15: (Appendix 8C)Broxterman Corporation has provided the following

Q20: Changing language ability from infancy to adulthood

Q24: Environments that encourage _ are not likely

Q24: (Appendix 12B)Sheinberg Corporation has two operating divisions-a

Q37: (Appendix 5A)Wienecke Corporation manufactures and sells one

Q43: Bluhm Corporation's management believes that every 2%

Q81: Whose score on the Bayley Scales of

Q82: The Bayley Scales of Infant Development<br>A) are

Q96: (Appendix 8C)Starrs Corporation has provided the following

Q104: Becky's six-month-old son obtained a high score