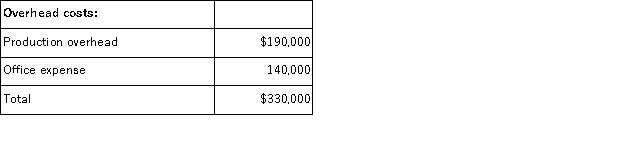

(Appendix 6A)Hasty Hardwood Floors installs oak and other hardwood floors in homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity based costing system:

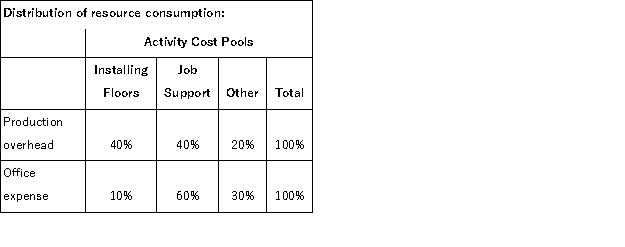

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

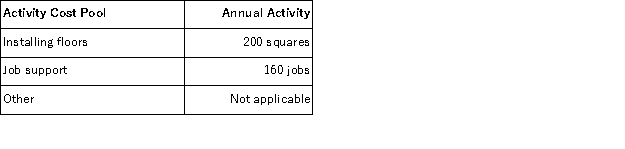

The amount of activity for the year is as follows:  A "square" is a measure of area that is roughly equivalent to 1, 000 square feet.

A "square" is a measure of area that is roughly equivalent to 1, 000 square feet.

Required:

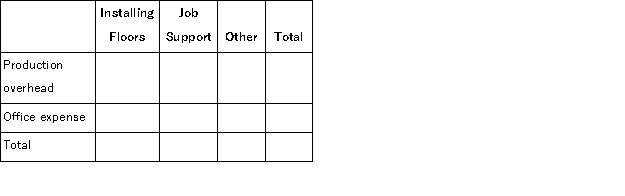

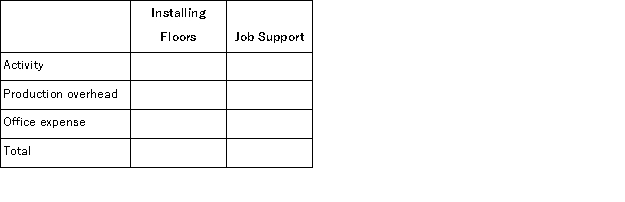

a.Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b.Compute the activity rates (i.e. , cost per unit of activity)for the Installing Floors and Job Support activity cost pools by filling in the table below:

b.Compute the activity rates (i.e. , cost per unit of activity)for the Installing Floors and Job Support activity cost pools by filling in the table below:  c.Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 3.4 squares.

c.Compute the overhead cost, according to the activity-based costing system, of a job that involves installing 3.4 squares.

Definitions:

Assets Inventory

A detailed list of an entity's possessions, including property, stock, and other valuables, often used for legal, financial, or insurance purposes.

Attestation Clause

A clause at the end of a document where witnesses affirm that the document was properly executed.

Testator's Signature

The signature of the individual who has made a will, necessary for its legal validation.

Formalities

Required procedures or steps that must be followed according to law or tradition, often in legal contracts or agreements.

Q4: (Appendix 12A)When a division is operating at

Q5: Five-month-olds can distinguish between two objects and

Q11: Intonation refers to<br>A) the production of vowel-like

Q22: Barry tells his three-year-old son, Billy, the

Q23: (Appendix 11A)Oldham Corporation bases its predetermined overhead

Q31: Some individuals with intellectual disabilities can learn

Q37: Trepan Corporation is contemplating the introduction of

Q48: Reetz Corporation would like to determine the

Q92: (Appendix 8C)Zangari Corporation has provided the following

Q98: (Appendix 8C)Helfen Corporation has provided the following