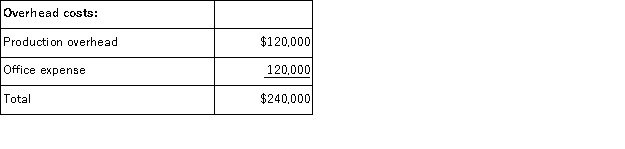

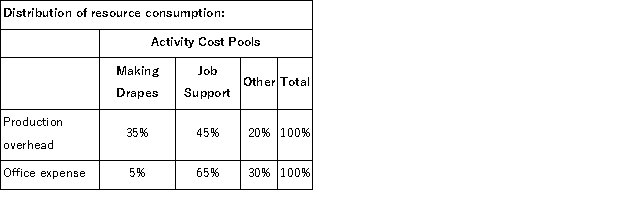

(Appendix 6A)Ingersol Draperies makes custom draperies for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

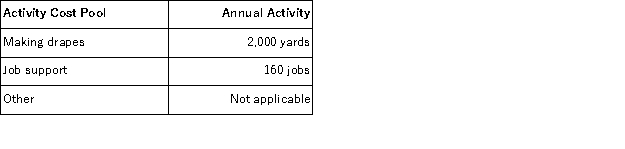

The amount of activity for the year is as follows:  Required:

Required:

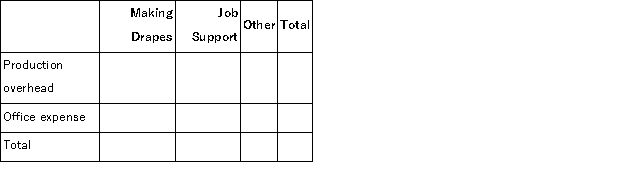

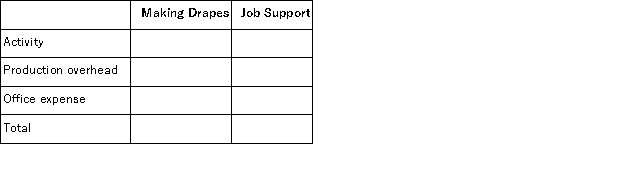

a.Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Drapes and Job Support activity cost pools by filling in the table below:

b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Drapes and Job Support activity cost pools by filling in the table below:  c.Prepare an action analysis report in good form of a job that involves making 71 yards of drapes and has direct materials and direct labor cost of $2, 510.The sales revenue from this job is $4, 400.

c.Prepare an action analysis report in good form of a job that involves making 71 yards of drapes and has direct materials and direct labor cost of $2, 510.The sales revenue from this job is $4, 400.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost;production overhead as a Red cost;and office expense as a Yellow cost.

Definitions:

Volume Variance

A financial metric that measures the difference between budgeted and actual volume of production or sales, impacting costs or revenues.

Fixed Factory Overhead

The portion of total factory overhead costs that remains constant regardless of the level of production or activity in a manufacturing facility.

Revenue Price Variance

The difference between the planned and actual unit sales price multiplied by the actual units sold.

Actual Revenues

The real amount of money received by a company from its business activities, without adjustments or estimations, in a specific period.

Q4: (Appendix 5A)Feltner Corporation manufactures and sells one

Q8: School-aged children<br>A) do not change their messages

Q12: (Appendix 8C)Prudencio Corporation has provided the following

Q15: (Appendix 4B)The management of Wray Corporation would

Q22: Dickson Corporation makes a product with the

Q33: A new product, an automated crepe maker,

Q39: Infants' early attempts to communicate include pointing,

Q48: Research with adopted children<br>A) typically reveals that

Q55: (Appendix 8C)Jessel Corporation has provided the following

Q136: (Appendix 8C)Glasco Corporation has provided the following