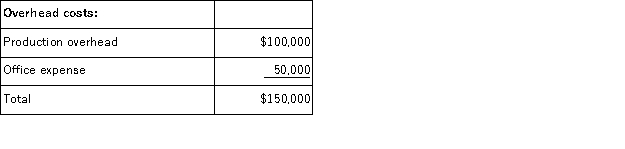

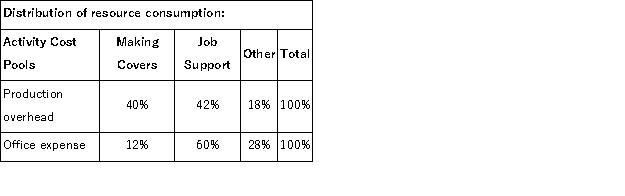

(Appendix 6A)Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

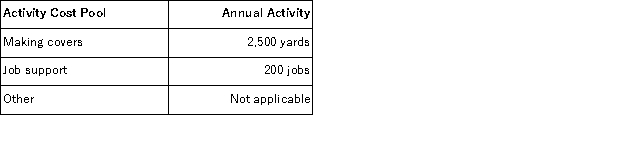

The amount of activity for the year is as follows:  Required:

Required:

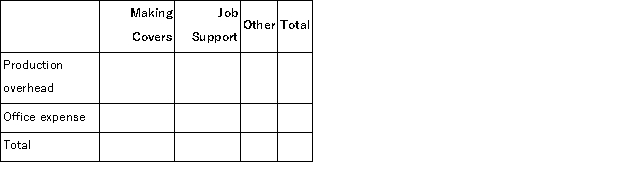

a.Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:

b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:  c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

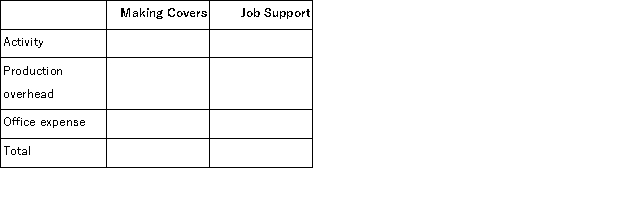

c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost;production overhead as a Red cost;and office expense as a Yellow cost.

Definitions:

Renal Pyramids

Cone-shaped masses within the kidney that contain nephrons where urine formation takes place.

Hilum

The part of an organ where blood vessels, nerves, and other structures enter or leave.

Medulla

The medulla, often referred to as the medulla oblongata, is the lower portion of the brainstem, controlling vital functions such as heart rate, breathing, and blood pressure.

Microblogs

Platforms that allow users to post short messages or updates, which can include text, images, or videos, for public viewing.

Q12: The management of Liess Corporation has provided

Q18: (Appendix 4B)The management of Aamot Corporation would

Q26: (Appendix 4B)The management of Benedict Corporation would

Q27: (Appendix 12B)For performance evaluation purposes, any variance

Q28: The best use of an infant intelligence

Q45: The same constrained resource is used by

Q72: The ability to use an effective memory

Q85: In the case of understanding metaphors, young

Q95: (Appendix 8C)A company needs an increase in

Q123: (Appendix 8C)Gloden Corporation has provided the following