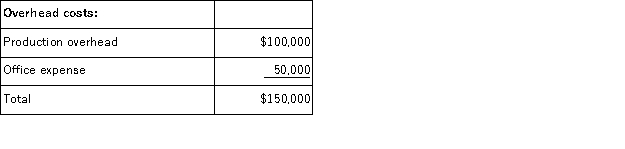

(Appendix 6A)Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

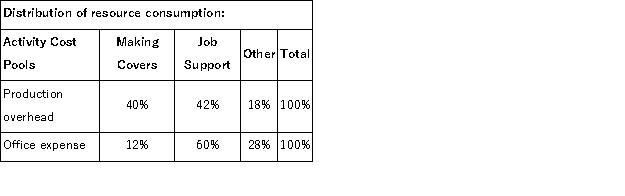

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

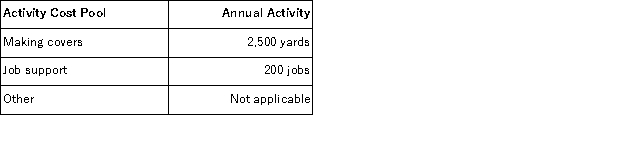

The amount of activity for the year is as follows:  Required:

Required:

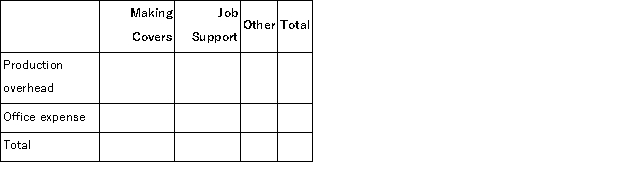

a.Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:

b.Compute the activity rates (i.e. , cost per unit of activity)for the Making Awnings and Job Support activity cost pools by filling in the table below:  c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

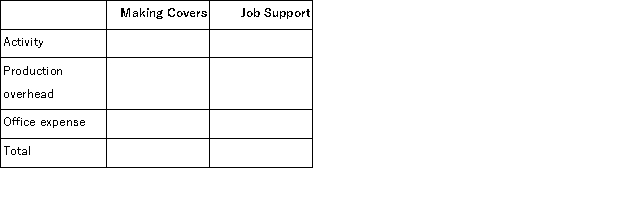

c.Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1, 500.The sales revenue from this job is $2, 500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost;production overhead as a Red cost;and office expense as a Yellow cost.

Definitions:

Semiannually

Occurring twice a year; every six months.

Zero-coupon Bond

A type of bond that does not pay interest during its life; it is sold at a discount from its face value and the return is realized when the bond matures.

Deep Discount

A situation where a bond or other investment is sold significantly below its par or face value.

Yield To Maturity

The total return expected on a bond if it is held until its maturity date, including all interest payments and capital gains or losses.

Q4: Effective communication is important throughout life. Give

Q5: When an unfamiliar word is heard, children

Q16: Modern definitions of giftedness are associated exclusively

Q25: Holly has normal intelligence, but is having

Q26: (Appendix 5A)Sagon Corporation manufactures and sells one

Q28: (Appendix 12B)For performance evaluation purposes, the lump-sum

Q53: When four-year-olds talk to two-year-olds, they<br>A) talk

Q70: (Appendix 8C)Pulkkinen Corporation has provided the following

Q77: Joanne and Dennis want to do all

Q110: (Appendix 11A)Acuff Corporation applies manufacturing overhead to