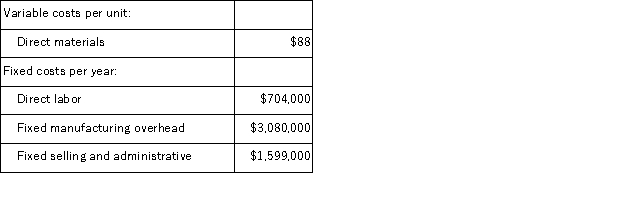

(Appendix 5A) Wienecke Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 44, 000 units and sold 41, 000 units.The company's only product is sold for $239 per unit. Assume that the company uses an absorption costing system that assigns $16 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 44, 000 units and sold 41, 000 units.The company's only product is sold for $239 per unit. Assume that the company uses an absorption costing system that assigns $16 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.The unit product cost under this costing system is:

Definitions:

Average Tax Rate

The proportion of total income that an individual or corporation pays in taxes, calculated by dividing the total tax by the taxable income.

Interest Income

The revenue earned from deposit accounts or investments through the interest payments received.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), representing the fraction of income or expenditure used to pay taxes.

Q10: Clulow Corporation recently changed the selling price

Q13: The same constrained resource is used by

Q19: Children, but not adolescents, often devise experiments

Q37: Trepan Corporation is contemplating the introduction of

Q51: Perwin Corporation estimates that an investment of

Q56: (Appendix 11A)A company has a standard cost

Q60: (Appendix 11A)The Adlake Corporation makes and sells

Q66: Locken Products Inc.makes two products-Q96T and T62D.Product

Q79: Hierarchical theories of intelligence<br>A) include only general

Q97: (Appendix 8C)Pont Corporation has provided the following