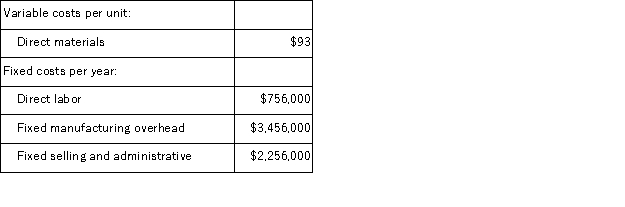

(Appendix 5A) Moffa Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 54, 000 units and sold 47, 000 units.The company's only product is sold for $256 per unit. The company is considering using either super-variable costing or a variable costing system that assigns $14 of direct labor cost to each unit that is produced.Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 54, 000 units and sold 47, 000 units.The company's only product is sold for $256 per unit. The company is considering using either super-variable costing or a variable costing system that assigns $14 of direct labor cost to each unit that is produced.Which of the following statements is true regarding the net operating income in the first year?

Definitions:

Liberal Return Policy

A company policy that allows customers to return purchased items with minimal restrictions, aiming to enhance customer satisfaction and trust.

Recognizes Revenue

The process of recording revenue in the financial statements when it is earned and realizable.

Factoring Arrangement With Recourse

A financial transaction where a business sells its receivables to a third party (factor) but must buy back any uncollected receivables, thus bearing the risk of default.

Holdback

A portion of the purchase price of an asset that is withheld until certain conditions have been met, ensuring fulfilment of contractual terms.

Q12: (Appendix 12A)The Red River Division of Alto

Q15: (Appendix 12A)Division 1 of Ace Company makes

Q24: Children's first questions<br>A) are marked by intonation

Q26: (Appendix 5A)Sagon Corporation manufactures and sells one

Q33: (Appendix 8C)Shinabery Corporation has provided the following

Q44: (Appendix 12B)Vancuren Corporation has two operating divisions-an

Q61: (Appendix 11A)The Santos Corporation made an error

Q77: (Appendix 11A)The fixed manufacturing overhead budget variance

Q80: (Appendix 11A)A company has a standard cost

Q105: (Appendix 11A)Nova Corporation produces a single product