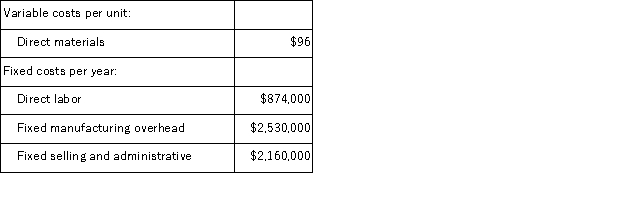

(Appendix 5A) Sirmons Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 46, 000 units and sold 45, 000 units.The company's only product is sold for $249 per unit. Assume that the company uses an absorption costing system that assigns $19 of direct labor cost and $55 of fixed manufacturing overhead to each unit that is produced.The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 46, 000 units and sold 45, 000 units.The company's only product is sold for $249 per unit. Assume that the company uses an absorption costing system that assigns $19 of direct labor cost and $55 of fixed manufacturing overhead to each unit that is produced.The net operating income under this costing system is:

Definitions:

Unrealized Gain

An unrealized gain is an increase in the value of an investment or asset that has not been sold, and consequently, the profit has not yet been taken or considered as income.

Fair Value Adjustment

Fair value adjustment involves altering the reported value of a company's assets or liabilities to reflect their current market values.

Investment Revenue

Income earned from various investments like stocks, bonds, or real estate.

Unrealized Loss

A loss that results from holding an asset that has decreased in value, but the asset has not yet been sold.

Q6: Rita was kept in a closet and

Q10: (Appendix 4A)Delaware Manufacturing Corporation has a traditional

Q18: Gardner's theory of intelligence<br>A) ignores the developmental

Q25: (Appendix 11A)A manufacturing company uses a standard

Q28: Adding -s and -ing are simple grammatical

Q37: (Appendix 8C)A capital budgeting project's incremental net

Q39: The one-to-one principle states that the last

Q50: Understanding learning disabilities is complicated because<br>A) they

Q71: Hannah is a school-aged child. Which of

Q125: (Appendix 8C)Voelkel Corporation has provided the following