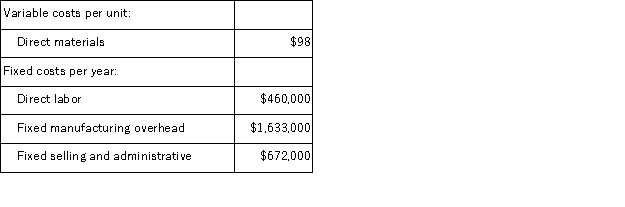

(Appendix 5A)Grand Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 23, 000 units and sold 21, 000 units.The company's only product is sold for $254 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 23, 000 units and sold 21, 000 units.The company's only product is sold for $254 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses a variable costing system that assigns $20 of direct labor cost to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

c.Assume that the company uses an absorption costing system that assigns $20 of direct labor cost and $71 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

d.Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

e.Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

IRR

An investment's IRR represents the discount rate that makes the sum of all future cash flows (positive and negative) from the investment equal to zero, effectively measuring its annual growth rate.

NPV

Net Present Value; the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Payback

The length of time it takes for an investment to generate an amount of money equal to the cost of the investment, used as a basic measure of the investment's risk.

Discounted Payback

The period of time it takes for an investment’s cash flows, discounted at a particular rate, to cover its initial cost.

Q6: (Appendix 2A)Sablan Inc.maintains a call center to

Q10: (Appendix 12A)Division T of Clocker Company makes

Q20: (Appendix 12B)Nathan Company has an Equipment Services

Q22: (Appendix 8C)Lanfranco Corporation is considering a capital

Q22: Barry tells his three-year-old son, Billy, the

Q23: (Appendix 8C)Zucker Corporation has provided the following

Q26: Hepler Corporation would like to use target

Q61: (Appendix 8C)Folino Corporation is considering a capital

Q84: The psychometric approach to intelligence<br>A) measures intelligence

Q93: (Appendix 8C)Blier Corporation has provided the following