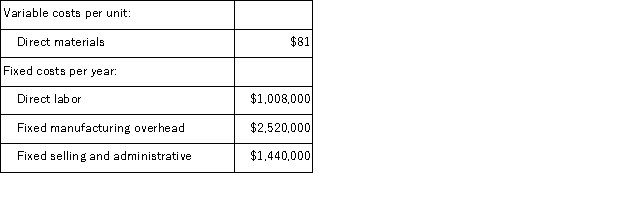

(Appendix 5A) Prehn Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 36, 000 units and sold 30, 000 units.The company's only product is sold for $251 per unit. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 36, 000 units and sold 30, 000 units.The company's only product is sold for $251 per unit. Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.The unit product cost under this costing system is:

Definitions:

Invoice Cost

The total cost shown on an invoice, comprising the purchase price of goods/services, along with taxes, shipping, and any other fees.

Straight-Line Method

A method of calculating depreciation of an asset, which evenly spreads the cost over its useful life.

Salvage Value

The estimated resale value of an asset at the end of its useful life, used in calculating depreciation expenses.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Q7: Your friend Elena has been asked to

Q11: Tests of infant intelligence do not generally

Q18: Desalvo Corporation is introducing a new product

Q52: (Appendix 8C)Welti Corporation has provided the following

Q54: If intelligence is made up of three

Q59: (Appendix 8C)Unless the organization is tax-exempt, income

Q60: (Appendix 11A)The Adlake Corporation makes and sells

Q61: (Appendix 8C)Folino Corporation is considering a capital

Q67: Which of the following is TRUE of

Q99: (Appendix 11A)The Murray Corporation uses a standard