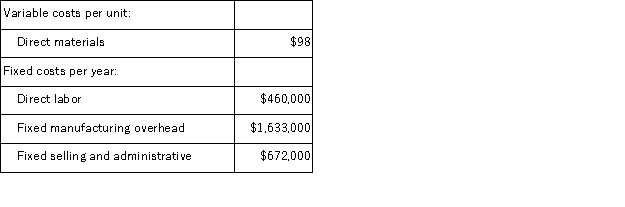

(Appendix 5A)Grand Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 23, 000 units and sold 21, 000 units.The company's only product is sold for $254 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 23, 000 units and sold 21, 000 units.The company's only product is sold for $254 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses a variable costing system that assigns $20 of direct labor cost to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

c.Assume that the company uses an absorption costing system that assigns $20 of direct labor cost and $71 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

d.Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

e.Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Self-Consciousness

An acute awareness of oneself, often leading to feeling scrutinized by others or overly aware of one's own actions or appearance.

Drug Tolerance

The reduction in the effect of a drug after repeated use, requiring higher doses to achieve the same effect.

States of Consciousness

The different levels of awareness of one's thoughts, feelings, and experiences, ranging from fully alert to various stages of sleep.

Selective Attention

Selective attention is the cognitive process of focusing on a particular object or task in the environment for a certain period, while ignoring irrelevant informations.

Q20: (Appendix 2A)Recent maintenance costs of Gallander Corporation

Q23: Erdahl Corporation's management believes that every 7%

Q31: (Appendix 12B)Vancuren Corporation has two operating divisions-an

Q35: Young infants who habituate to visual stimuli

Q46: Alley Corporation's vice president in charge of

Q64: (Appendix 11A)The Murray Corporation makes and sells

Q67: Which of the following is TRUE of

Q96: (Appendix 8C)Starrs Corporation has provided the following

Q101: Creativity<br>A) is associated with convergent thinking.<br>B) cannot

Q104: (Appendix 8C)Skolfield Corporation is considering a capital