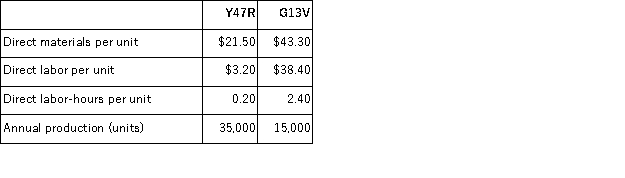

(Appendix 4A)Riha Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products, Y47R and G13V, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1, 879, 960 and the company's estimated total direct labor-hours for the year is 43, 000.

The company's estimated total manufacturing overhead for the year is $1, 879, 960 and the company's estimated total direct labor-hours for the year is 43, 000.

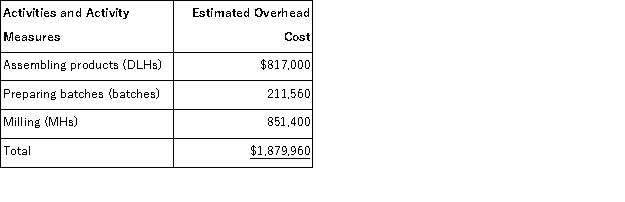

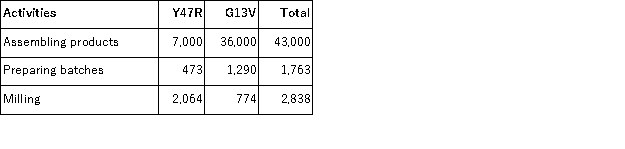

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Definitions:

Opportunity Cost

The expense incurred by not selecting the second best choice while making a decision or opting among alternatives.

Debt Default

The failure to meet the legal obligations of a loan, such as not making scheduled payments on time.

U.S. Federal Budget

The government's estimate of revenue and spending for a fiscal year that is proposed by the President and approved by Congress.

Federal Deficits

The shortfall where the government's expenditures exceed its revenues within a specific fiscal year.

Q2: The general developmental trend for scientific reasoning

Q5: (Appendix 11A)Pohl Corporation uses a standard cost

Q6: (Appendix 12B)Soland Corporation has two operating divisions-an

Q9: According to Siegler's overlapping waves model, children

Q28: Dickson Corporation makes a product with the

Q36: Children derive meaning by combining words to

Q37: (Appendix 8C)A capital budgeting project's incremental net

Q49: You show five-month-old Zachary many pictures of

Q57: (Appendix 8C)Erling Corporation has provided the following

Q84: The psychometric approach to intelligence<br>A) measures intelligence