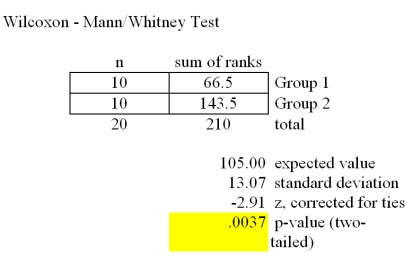

Refer to the Mega-Stat/Excel output for the Wilcoxon rank sum test given in the table below.  At a significance level of .05,which one of the following statements is correct regarding the following null hypothesis? H0: D1 is shifted to the right or left of D2

At a significance level of .05,which one of the following statements is correct regarding the following null hypothesis? H0: D1 is shifted to the right or left of D2

Definitions:

Equivalent Annual Cost

A financial analysis tool used to compare the cost effectiveness of different assets by breaking down their costs into equivalent annual amounts.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time for an investment.

Internal Rate of Return

Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of potential investments, representing the discount rate at which the net present value of costs (cash outflows) and benefits (cash inflows) of an investment equal zero.

Net Working Capital

A financial metric that represents the difference between a company's current assets and current liabilities.

Q6: Following the social-conflict approach,what are the problems

Q7: The alternatives 1 and 2 in the

Q7: How is Canadian sociology distinct from American

Q26: The sign test is a test about

Q36: The linear regression trend model was applied

Q60: Which of the following founding sociologists urged

Q68: A sequence of values of some variable

Q82: Maximin is a criterion used when making

Q109: Below is a partial multiple regression ANOVA

Q110: A p-chart is a control chart on