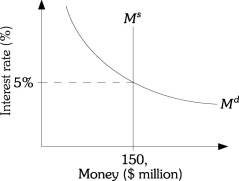

Refer to the information provided in Figure 11.3 below to answer the questions that follow.

Figure 11.3

Figure 11.3

-Refer to Figure 11.3.A decrease in nominal aggregate output,ceteris paribus,will likely

Definitions:

Zero-Coupon Bond

A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.

Purchase Price

The amount of money that has been agreed upon to buy an asset, product, or service.

Face Value

The nominal value stated on a financial instrument, such as a bond or stock, representing its legal value at issuance or redemption.

Zero-Coupon Bond

A type of bond that does not pay periodic interest payments and is issued at a discount from its face value.

Q24: The speculative demand for money is<br>A)positively related

Q34: Refer to Figure 11.7.If the demand for

Q60: The quantity of output supplied at different

Q61: The Federal Reserve's policy to "lean against

Q89: Partial balance sheets and additional information are

Q105: Creditors and investors would generally find the

Q106: Assume the current one-year interest rate on

Q106: The members of the Board of Governors

Q109: Generally speaking, cash flows from operating activities

Q113: Other things equal,an increase in the price