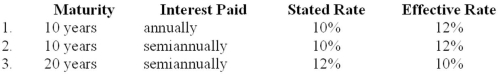

Determine the price of a $500,000 bond issue under each of the following independent assumptions:

Definitions:

Set Notation

A systematic way of writing sets, often using curly braces and symbols to define elements and operations on sets.

Absolute Value Inequality

An inequality that involves the absolute value of an expression, requiring consideration of both the positive and negative cases.

Absolute Value Inequality

An inequality that involves the absolute value of a variable expression, requiring consideration of both positive and negative scenarios.

Interval

A range of values or a segment of a number line, often specified by its endpoints.

Q1: Silver Springs Company has an unfunded retiree

Q15: A $500,000 bond issue sold for 98.

Q35: Which of the following increases the investment

Q56: On January 1, 2013, Cool Universe issued

Q62: Two independent situations are described below. Each

Q82: Bencorp issues a $90,000, 6-month, noninterest-bearing note

Q88: Due to differences between depreciation reported in

Q90: At the beginning of 2013, Angel Corporation

Q107: When bonds are sold at a discount,

Q108: A guaranteed residual value at the inception