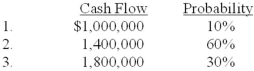

Calegari Mining paid $2 million to obtain the rights to operate a coal mine in Tennessee. Costs of exploring for the coal deposit totaled $1,500,000, and development costs of $5 million were incurred in preparing the mine for extraction, which began on January 2, 2013. After the coal is extracted in approximately five years, Calegari is obligated to restore the land to its original condition. The company's controller has provided the following three cash flow possibilities for the restoration costs:  The company's credit-adjusted, risk-free rate of interest is 7%, and its fiscal year ends on December 31.

The company's credit-adjusted, risk-free rate of interest is 7%, and its fiscal year ends on December 31.

Required:

1. What is the initial cost of the coal mine? (Round computations to nearest whole dollar.)

2. How much accretion expense will Calegari report in its 2013 and 2014 income statements?

3. What is the carrying value (book value) of the asset retirement obligation that Calegari will report in its 2013 and 2014 balance sheets?

4. Assume that actual restoration costs incurred in 2018 totaled $1,370,000. What amount of gain or loss will Calegari recognize on retirement of the liability?

Definitions:

Pain management

A branch of medicine focused on reducing pain and improving the quality of life for those suffering from acute or chronic pain.

Emotional care

Providing support that addresses the emotional and psychological well-being of an individual.

Selective optimization

A strategy of focusing on and optimizing key areas of functioning while compensating for declines in other areas, often used in the context of aging.

Compensation

The act of making amends for something inadequate or a loss, often referring to payment given for work done or for the settlement of a claim.

Q18: Volt Electronics sells equipment that includes a

Q29: Ending inventory using the average cost method

Q37: Diversified Industries sells perishable electronic products. Some

Q53: a) What non-accounting factors are important before

Q57: Baker Inc. acquired equipment from the manufacturer

Q70: Assume the same facts as above, except

Q79: Required:<br>Determine the amount, if any, of the

Q92: On October 1, 2013, Justine Company purchased

Q107: A change in the estimated recoverable units

Q111: Lake Incorporated purchased all of the outstanding