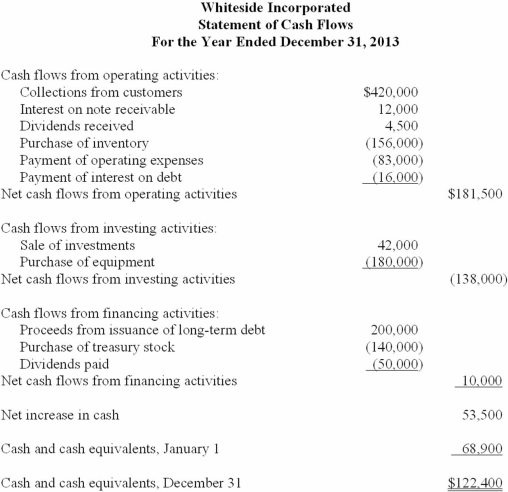

The statement of cash flows for the year ended December 31, 2013, for Whiteside Incorporated is presented below.  Required:

Required:

Prepare the statement of cash flows assuming that Whiteside prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements.

Definitions:

Federal Income Tax

A tax levied by the government on the annual income of individuals, corporations, trusts, and other legal entities.

Net Pay

The amount of an employee's earnings after all deductions, including taxes and retirement contributions, have been subtracted.

FICA Tax

A United States federal payroll tax that funds Social Security and Medicare, deducted from employees’ paychecks and matched by employers.

Federal Income Tax

A tax levied by the United States Internal Revenue Service (IRS) on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q12: For each posted entry in the Allowance

Q21: Required:<br>Prepare a 2013 multiple-step income statement for

Q48: The calculation of future value requires the

Q49: Required:<br>Prepare a single-step income statement with basic

Q50: An amount that has been incurred as

Q60: Long-term liabilities

Q60: A company gives a two-year warranty for

Q106: The adjusting entry required to record accrued

Q116: Describe what is meant by prepaid expenses

Q148: Assuming BCC used the completed contract method