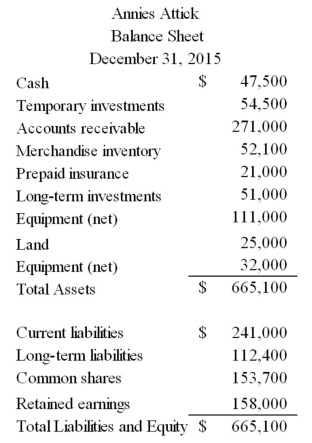

Annies Attick reported the following information for December 31.  (1)Explain the purpose of the acid-test ratio.

(1)Explain the purpose of the acid-test ratio.

(2)Calculate the acid-test ratio.

(3)What does the acid-test ratio reveal about Annies Attick?

Definitions:

Total U.S. Workforce

The complete count of all employed individuals within the United States, including both private and public sectors.

Total Revenue

The complete sum of financial income generated by an entity from its various activities, including sales, donations, services, and investments.

Charitable Nonprofits

Organizations that are established for philanthropic purposes and are exempt from federal income tax under section 501(c)(3) of the IRS code.

Tax-Exempt

The status granted to organizations that exempts them from paying certain taxes due to their charitable, educational, or religious nature.

Q8: On January 1,Year 1,Froelich Corporation purchased 5,500

Q29: Secured bonds:<br>A) Have specific assets of the

Q32: The Merchandise Inventory for Year 1 was

Q33: Prof Inc borrowed $200,000 from the bank

Q50: If a company has cash available for

Q56: As a significant influence investment,Music City held

Q126: Bonds owned by investors whose names and

Q160: Which of the following was true of

Q238: Staley Tile Company has assets with a

Q272: The comparative balance sheet for Seasons Corp