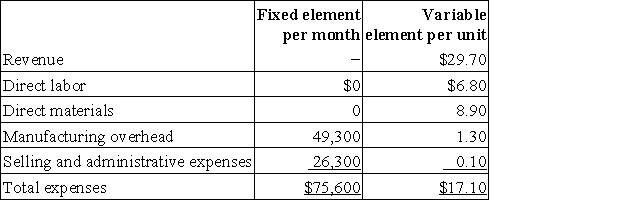

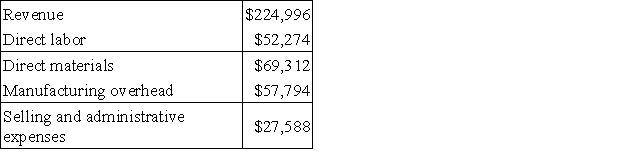

Coderre Corporation manufactures and sells a single product.The company uses units as the measure of activity in its budgets and performance reports.During July,the company budgeted for 7,800 units,but its actual level of activity was 7,780 units.The company has provided the following data concerning the formulas used in its budgeting and its actual results for July: Data used in budgeting:  Actual results for July:

Actual results for July:  The direct labor in the planning budget for July would be closest to:

The direct labor in the planning budget for July would be closest to:

Definitions:

Average Fixed Costs

Costs that do not vary with the level of output and are averaged over the total number of units produced.

Marginal Costs

The expense associated with manufacturing an extra unit of a product or service.

TVC

The total expenses a firm incurs that increase or decrease with the level of output, essentially another term for total variable costs with a rephrased definition.

AVC

Average Variable Cost, which is the total variable costs divided by the quantity of output produced, reflecting the variable cost per unit.

Q48: A project requires an initial investment of

Q69: A common fixed cost is a fixed

Q90: Faas Wares is a division of a

Q105: The investment required for the project profitability

Q108: Davey Corporation is preparing its Manufacturing Overhead

Q118: Which of the following costs at a

Q167: The direct materials budget is typically prepared

Q255: Lantagne Clinic uses client-visits as its measure

Q292: The Collins Corporation uses standard costing and

Q362: Pardoe Inc. ,manufactures a single product in