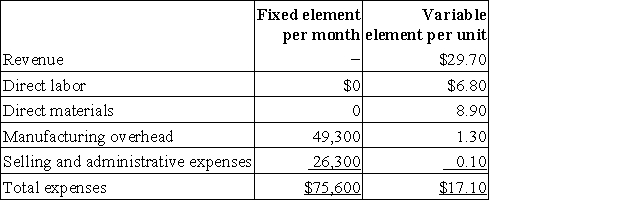

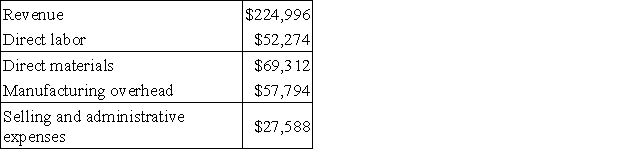

Coderre Corporation manufactures and sells a single product.The company uses units as the measure of activity in its budgets and performance reports.During July,the company budgeted for 7,800 units,but its actual level of activity was 7,780 units.The company has provided the following data concerning the formulas used in its budgeting and its actual results for July: Data used in budgeting:  Actual results for July:

Actual results for July:  The direct materials in the flexible budget for July would be closest to:

The direct materials in the flexible budget for July would be closest to:

Definitions:

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation and signifies a claim on part of the corporation's assets and earnings.

Operating Activities

The day-to-day activities of a company involved in producing and selling its products or providing services, which generate most of the company's cashflows.

Indirect Method

A technique used in cash flow statements to adjust net income for non-cash transactions, depreciation, and changes in working capital.

Depreciation Expense

The portion of an asset's initial cost allocated over a specific period as an expense, reflecting its usage and deterioration.

Q4: The budgeted selling and administrative expense is

Q35: Common fixed costs should not be charged

Q36: Process Time is the only non-value-added component

Q44: The TS Corporation has budgeted sales for

Q52: Zike Corporation's static planning budget for October

Q63: In a merchandising company,the required merchandise purchases

Q89: Warburton Corporation has two divisions: Alpha and

Q101: A manufacturing company that produces a single

Q111: Beltram Corporation's balance sheet and income statement

Q186: Leaphart Kennel uses tenant-days as its measure