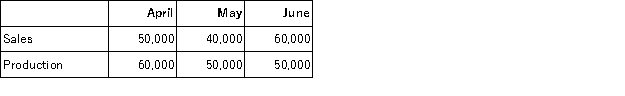

Clay Corporation has projected sales and production in units for the second quarter of the coming year as follows:  Cash-related production costs are budgeted at $5 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses will amount to $100,000 per month.The accounts payable balance on March 31 totals $190,000,which will be paid in April.

Cash-related production costs are budgeted at $5 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses will amount to $100,000 per month.The accounts payable balance on March 31 totals $190,000,which will be paid in April.

All units are sold on account for $14 each.Cash collections from sales are budgeted at 60% in the month of sale,30% in the month following the month of sale,and the remaining 10% in the second month following the month of sale.Accounts receivable on April 1 totaled $500,000 ($90,000 from February's sales and $410,000 from March's sales).

Required:

a.Prepare a schedule for each month showing budgeted cash disbursements for Clay Corporation.

b.Prepare a schedule for each month showing budgeted cash receipts for Clay Corporation.

Definitions:

Philippines

A Southeast Asian country in the Western Pacific, comprising more than 7,000 islands.

Work Disincentives

Factors or conditions that discourage individuals from seeking or maintaining employment, often due to economic policies or social benefits structures.

Anti-Poverty Programs

Government or non-government initiatives designed to reduce or eliminate poverty by providing support and resources to the needy.

Inefficiency

The state of not achieving maximum productivity or economic benefit from resources due to suboptimal allocation, processes, or decisions.

Q15: A cement manufacturer has supplied the following

Q29: The "costs to be accounted for" portion

Q89: Warburton Corporation has two divisions: Alpha and

Q102: LFM Corporation makes and sells a product

Q110: Sammis Inc. ,which produces and sells a

Q120: Poriss Corporation makes and sells a single

Q131: Arakaki Inc.is working on its cash budget

Q219: Vath Corporation,which makes landing gears,has provided the

Q352: Smyer Corporation makes a product with the

Q355: Dancause Corporation manufactures and sells a single