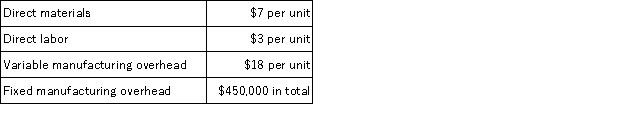

During its first year of operations,Carlos Manufacturing Corporation incurred the following costs to produce 8,000 units of its only product:  The company also incurred the following costs in selling 7,500 units of product during its first year:

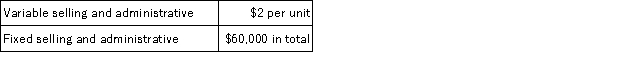

The company also incurred the following costs in selling 7,500 units of product during its first year:  Assume that direct labor is a variable cost. Under variable costing,what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Assume that direct labor is a variable cost. Under variable costing,what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Definitions:

Significant Variances

Discrepancies between planned and actual figures that are large enough to warrant attention and possibly corrective action by management.

Cost Control

A process of managing and monitoring expenses to keep business operations within a budget.

Responsibility Accounting

A system of accounting which holds individuals or departments accountable for costs and expenses under their control.

Sales Manager

A professional responsible for leading and directing a sales team to meet or exceed sales targets.

Q28: Ledezma Corporation makes a product with the

Q28: In December,one of the processing departments at

Q33: Pulo Corporation uses a weighted-average process costing

Q63: Yuvil Corporation produces a single product.At the

Q65: Comings Corporation produces and sells two products.In

Q95: Iancu Corporation,which has only one product,has provided

Q116: The following are budgeted data for the

Q123: Pardoe Inc. ,manufactures a single product in

Q163: Data concerning Marchman Corporation's single product appear

Q365: During January,Desousa Clinic plans for an activity