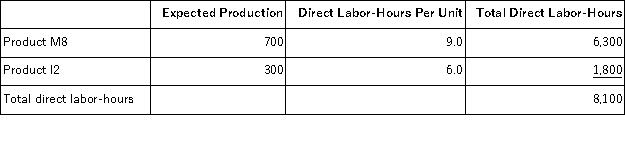

Karsten,Inc. ,manufactures and sells two products: Product M8 and Product I2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

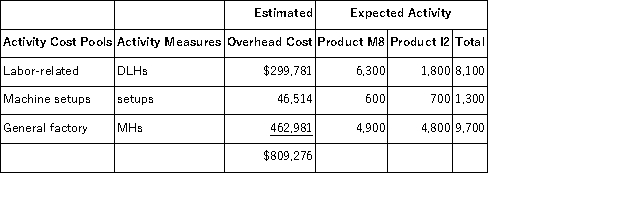

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product I2 under activity-based costing is closest to:

The unit product cost of Product I2 under activity-based costing is closest to:

Definitions:

Growth Rate

The rate at which a company's sales, earnings, dividends, or other financial indicators increase over a period of time.

EBIT

A profitability metric, Earnings Before Interest and Taxes, includes all company expenses with the exception of interest and tax charges.

Tax Rate

A proportion or rate at which an individual or business is taxed by the government, often expressed as a percentage.

Q24: Boutet,Inc. ,manufactures and sells two products: Product

Q46: The ending balance of accounts receivable was

Q51: Shauer,Inc. ,produces and sells a single product

Q67: Sosinski Corporation has two divisions: Domestic Division

Q75: Dapper Corporation had only one job in

Q116: Moallankamp Corporation produces and sells a single

Q126: Lore Corporation has provided the following information:

Q146: In activity-based costing,unit product costs computed for

Q162: Lasorsa Corporation manufactures a single product.Variable costing

Q176: Farron Corporation,which has only one product,has provided