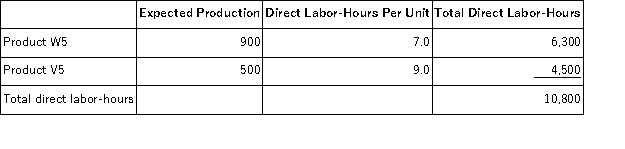

Parody,Inc. ,manufactures and sells two products: Product W5 and Product V5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.30 per DLH.The direct materials cost per unit for each product is given below:

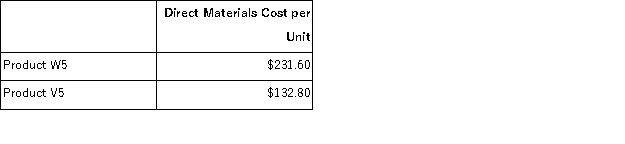

The direct labor rate is $16.30 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

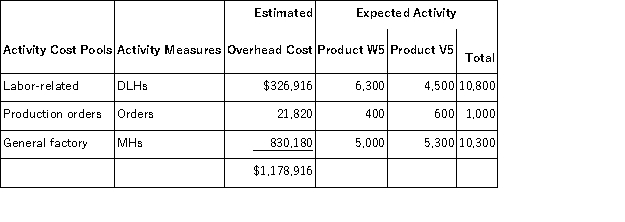

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours.Compute the company's predetermined overhead rate under this costing method.

b.How much overhead would be applied to each product under the company's traditional costing method?

c.Determine the unit product cost of each product under the company's traditional costing method.

d.Compute the activity rates under the activity-based costing system.

e.Determine how much overhead would be assigned to each product under the activity-based costing system.

f.Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Business Influence

The impact that businesses have on society, economy, politics, and the environment through their practices, products, and policies.

Public Healthcare Sector

The part of the healthcare system that is owned and operated by the government and is funded by taxes, providing services to the general public.

Private Healthcare Sector

Health services provided by entities other than the government, often requiring direct payment or insurance coverage.

Collaborative

Involving two or more parties working together towards a common goal or objective, often emphasizing teamwork and partnership.

Q4: Hache Corporation uses the weighted-average method in

Q11: Gabat Inc.is a merchandising company.Last month the

Q31: Garhart Corporation uses the following activity rates

Q41: If the actual quantity of materials used

Q43: A company has a standard cost system

Q57: During February,Irving Corporation incurred $65,000 of actual

Q92: Filosa,Inc. ,manufactures and sells two products: Product

Q99: Able Inc.uses the weighted-average method in its

Q142: In December,Mccullum Corporation sold 2,900 units of

Q164: Electrical costs at one of Kantola Corporation's