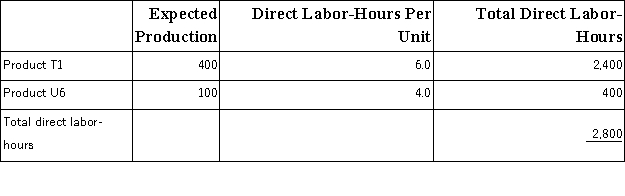

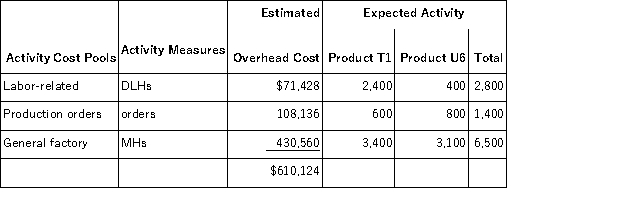

Pachero,Inc. ,manufactures and sells two products: Product T1 and Product U6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.90 per DLH.The direct materials cost per unit is $259.80 for Product T1 and $188.80 for Product U6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $15.90 per DLH.The direct materials cost per unit is $259.80 for Product T1 and $188.80 for Product U6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product T1 under activity-based costing is closest to:

The unit product cost of Product T1 under activity-based costing is closest to:

Definitions:

Law-Firm Personnel

Law-firm personnel include all individuals working in a law firm, such as lawyers, paralegals, legal assistants, and administrative staff, each contributing to the firm's operations and services.

Paralegals

Legal professionals who assist attorneys in the delivery of legal services, conducting legal research, drafting documents, and performing administrative tasks.

Legal Administrators

Professionals responsible for managing operations in law firms, corporate legal departments, or government agencies.

Office Manager

A person responsible for the smooth operation of the day-to-day administrative tasks within an office setting, ensuring organizational effectiveness and efficiency.

Q1: Pevy Corporation has two divisions: Southern Division

Q2: Epolito Corporation incurred $87,000 of actual Manufacturing

Q8: If direct labor-hours is used as the

Q48: Farnor,Inc. ,would like to estimate the variable

Q63: The following partially completed T-accounts summarize transactions

Q69: Walborn Corporation uses the weighted-average method in

Q132: Data concerning Hinkson Corporation's single product appear

Q177: Seiersen Corporation's contribution format income statement for

Q178: The selling price of Roscioli Corporation's only

Q184: Lamon,Inc. ,manufactures and sells two products: Product