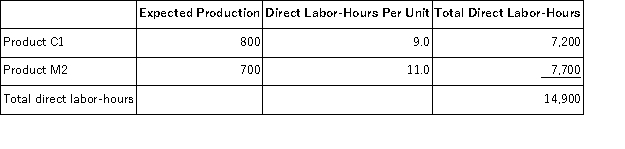

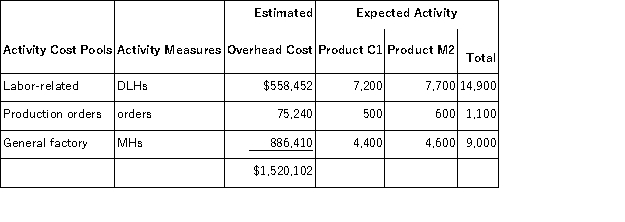

Machuga,Inc. ,manufactures and sells two products: Product C1 and Product M2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product C1 under activity-based costing is closest to:

The overhead applied to each unit of Product C1 under activity-based costing is closest to:

Definitions:

Q4: A partial listing of costs incurred during

Q15: Carr Corporation's comparative balance sheet and income

Q20: The plant manager's work is an example

Q35: During the month of May,Marian Manufacturing Corporation

Q38: An unfavorable materials quantity variance is recorded

Q40: Pinkney Corporation has provided the following data

Q78: The following information relates to the Assembly

Q95: Stelmack Corporation,a manufacturing Corporation,has provided data concerning

Q153: Harris Corporation is a wholesaler that sells

Q157: Which of the following costs,if expressed on