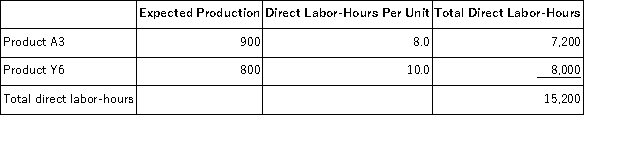

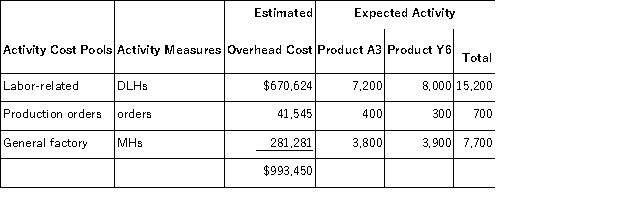

Mellencamp,Inc. ,manufactures and sells two products: Product A3 and Product Y6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.20 per DLH.The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $24.20 per DLH.The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product Y6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product Y6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

Definitions:

Net Working Capital

A measure of a company's liquidity, calculated as current assets minus current liabilities, indicating the short-term financial health and operational efficiency of a business.

Fixed Assets

Long-term tangible assets used in the operation of a business and not expected to be converted to cash in the near term.

Operating Capacity

The maximum output a company can produce using its current resources without compromising quality or efficiency.

Sales Projection

An estimate of the sales revenue that a company expects to achieve in a future period.

Q12: Freeport Corporation's income statement for last year

Q22: Baker Corporation applies manufacturing overhead on the

Q56: Fulton Corporation uses the weighted-average method in

Q64: Emco Company uses direct labor cost as

Q110: Calip Corporation,a merchandising company,reported the following results

Q113: Schoff Corporation has provided the following data

Q131: Olide,Inc. ,manufactures and sells two products: Product

Q134: Selling costs can be either direct or

Q161: Hewett,Inc. ,manufactures and sells two products: Product

Q186: Cleckley Corporation's operating leverage is 5.9.If the