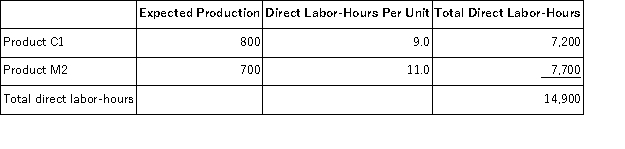

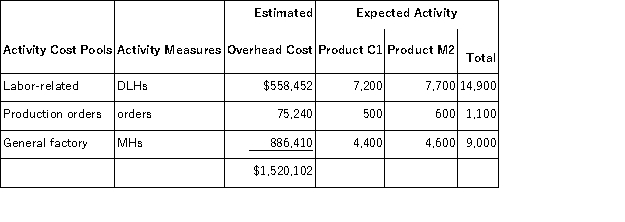

Machuga,Inc. ,manufactures and sells two products: Product C1 and Product M2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product C1 under activity-based costing is closest to:

The overhead applied to each unit of Product C1 under activity-based costing is closest to:

Definitions:

Initial Outlays

The initial investments required to start a project or purchase an asset, often including costs such as capital expenditure and working capital.

Revenue Forecasts

Predictions about the amount of money a company is expected to generate in future periods through sales or other income.

Large Projects

Significant endeavors undertaken by businesses or governments, characterized by large investment, significant complexities, and long durations, often involving infrastructure or technology.

Accounting Income

Accounting income is the net profit of a company, calculated according to generally accepted accounting principles (GAAP), and includes all revenues and expenses.

Q3: Galbraith Corporation applies overhead cost to jobs

Q4: How much would you have to invest

Q20: Carver Inc.uses the weighted-average method in its

Q52: Caber Corporation applies manufacturing overhead on the

Q58: Meyers Corporation had the following inventory balances

Q76: Minon,Inc. ,manufactures and sells two products: Product

Q95: Mahaxay Corporation has provided its contribution format

Q125: Frogge,Inc. ,manufactures and sells two products: Product

Q137: A manufacturer of premium wire strippers has

Q179: Younger Corporation reports that at an activity