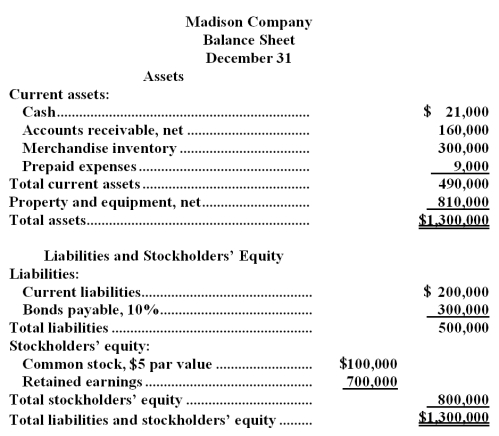

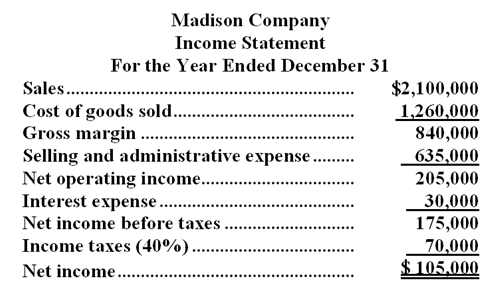

Recent financial statements for Madison Company are given below:

Madison Company paid dividends of $3.15 per share during the year.The company's common stock had a market price of $63 per share on December 31.Assets at the beginning of the year totaled $1,100,000 and stockholders' equity totaled $725,000.

Required:

Compute the following:

a.Earnings per share of common stock.

b.Dividend payout ratio.

c.Dividend yield ratio.

d.Price-earnings ratio.

e.Return on total assets.

f.Return on common stockholders' equity.

g.Was financial leverage positive or negative for the year? Explain.

Definitions:

Peanuts

Informally, a very small or insignificant amount of money; literally, a legume crop grown mainly for its edible seeds.

Raisins

Dried grapes often used as a snack or cooking and baking ingredient.

Central Office

A telecommunications term referring to a facility where customers' calls are switched by the local central office of a telecommunications provider.

Recordkeeping

The systematic process of maintaining and organizing records or documents relevant to a business, institution, or individual.

Q9: The current ratio at the end of

Q15: Which of the following would be classified

Q24: The payback period of this investment is

Q71: Find the limit <span class="ql-formula"

Q80: Cash payments to retire bonds payable are

Q92: For what values of x is

Q124: If Dunford has a limit of 20,000

Q128: At what selling price per unit should

Q188: When computing the acid-test ratio,a short-term note

Q211: Brewster Company has an acid-test ratio of