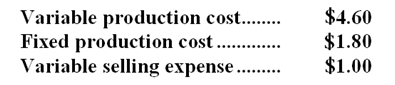

The Immanuel Company has just obtained a request for a special order of 6,000 jigs to be shipped at the end of the month at a selling price of $7 each. The company has a production capacity of 90,000 jigs per month with total fixed production costs of $144,000. At present, the company is selling 80,000 jigs per month through regular channels at a selling price of $11 each. For these regular sales, the cost for one jig is:  If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

-At what selling price per unit should Immanuel be indifferent between accepting or rejecting the special offer?

Definitions:

Monopoly Privileges

Exclusive rights granted to a company or entity to operate as the sole provider of a product or service in a specific market or region.

Financial Statement Data

This refers to the quantitative information contained in the financial statements of a company, including the balance sheet, income statement, and cash flow statement, used for analysis.

Equity Offerings

The sale of equity or shares in a company to raise capital, usually through public offerings or private placements.

Debt Offerings

A way for companies to raise capital by issuing debt securities or bonds to investors, who in return receive interest payments.

Q35: (Ignore income taxes in this problem. )The

Q45: Suppose the selling price of the upgraded

Q47: If the actual direct labor-hours used is

Q55: The labor rate variance for September was:<br>A)$1,530

Q72: Standard costs greatly increase the complexity of

Q74: The net cash provided by (used in)financing

Q94: The variable overhead efficiency variance for October

Q99: How much profit (loss)does the company make

Q100: Masse Corporation uses part G18 in one

Q112: Power Systems Inc.manufactures jet engines for the